About the Lending Therapist

About the Business

The Lending Therapist helps people navigate the complex world of lending and connects them to the money they need to meet their obligations and aspirations for life.

The owner-operated business was founded in 2003 by Leath Margrie, an Adelaide-based finance broker who has been offering tailored loan solutions for home buyers, property investors, and small business owners across Australia since 2003.

Leath’s deep passion for guiding others is the heart of the business (and the inspiration behind the use of “therapist”). He goes beyond the standard questions, helping clients think strategically and holistically about their financial position and opportunities.

Clients value Leath’s authenticity, proactive communication and ability to know when to give them time or a gentle nudge to help them feel supported and stay on track.

Whether excitement or a complex situation has brought you here, Leath will be a steadfast support from start to finish to help you find the right loan for your situation that also gives you a solid foundation for the future.

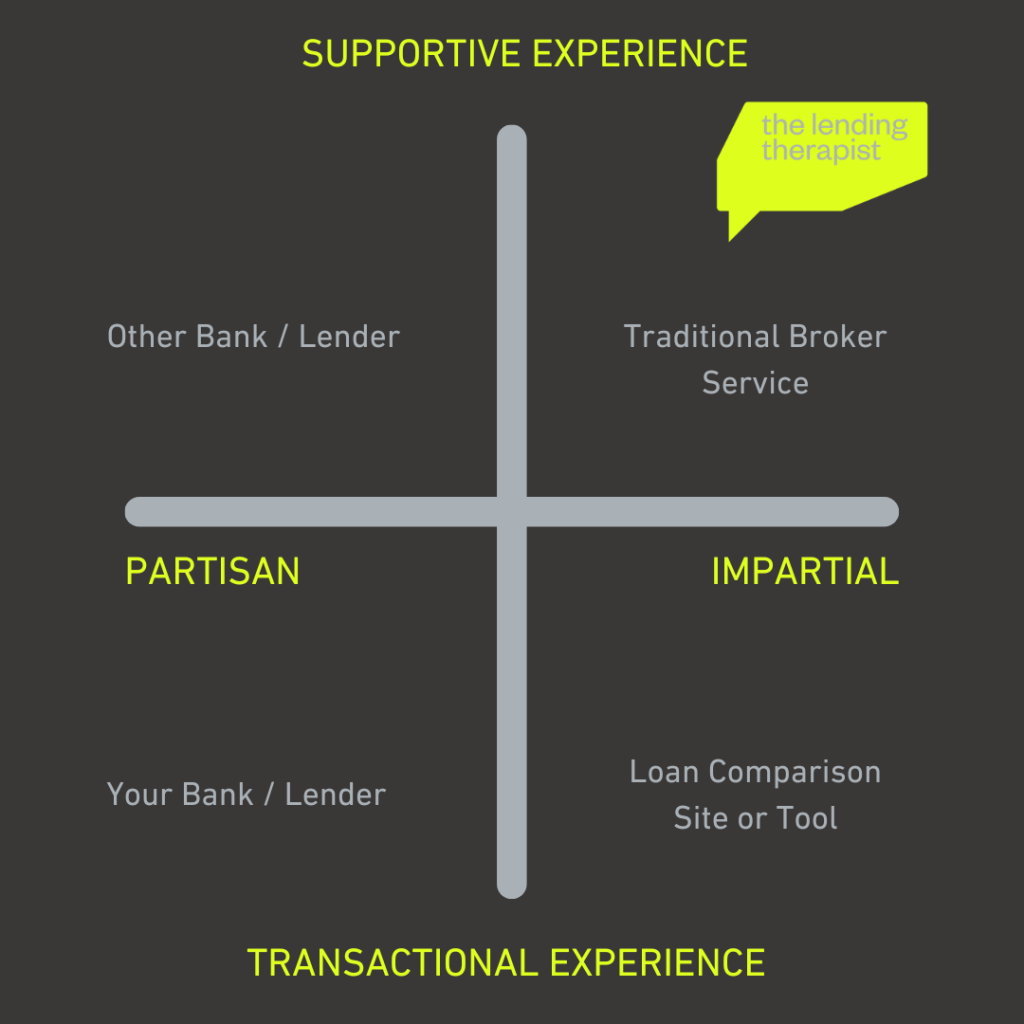

There are many ways to find a loan, and everyone values different service experiences.

The Lending Therapist stands out by offering a highly supportive, holistic, and attentive service. It’s the ideal choice for those seeking a rare blend of trusted expert guidance, tailored loan solutions, and a genuinely caring approach.

About the owner, Leath Margrie

The supportive ‘never leave any stone unturned’ service experience I give my clients today has been decades in the making.

I spent my high school years in Waikerie, in regional South Australia. Working different jobs as a teenager taught me the value of hard work, resilience, resourcefulness and taking on that country value of doing the right thing by people. From there, I embarked on a 10-year career with the Royal Australian Air Force where my job was to maintain aircraft in a technical role. This is where I started my journey of sharpening my troubleshooting skills, liaising with different parties and enhancing my discipline and loyalty skills.

During that time, I was lucky enough to find an experienced broker that assisted my family on our property journey. That’s where my passion for lending and helping others began and it led to me joining the broking industry via “Aussie Mortgage Market” back in 2003.

My superpower comes from working with different people over the years – translating the complex into bite-size, digestable pieces. Often I get feedback of making the process a lot easier to understand, which in turn, reduces confusion and stumbling blocks. I use this superpower and a dash of humour to create an environment of trust, reduce overwhelm and set up good communication. In this game, building different and strong relationships with key partners allows me to bring a higher level of service which translates into richer and greater benefits to my clients today.

I am a Member of the Finance Brokers Association of Australia (FBAA), the Australian Finance Complaints Authority (AFCA) and the Property Investment Professionals of Australia (PIPA) whose accreditation – Qualified Investment Property Advisor – I completed back in 2015. I am committed to my profession and driven to contribute to the finance landscape by helping the individuals I work with feel empowered to stride confidently toward their aspirations.

Balancing the business side with other interests includes volunteer roles such a Team Manager for my son’s sports team, running a small business celebration monthly event – Lethal Lunch – and the flexibility of working from home allows me to support my children to grow and do their activities. This also allows me to support my wife on her work journey. Getting away to our holiday home, short travel trips around Australia and trying my best to stay fit at the gym and through running is a big part of my routine.

Ready to take the next step towards your future?

Great Extra Benefits

On top of a supportive holistic service, you’ll receive other great benefits by choosing The Lending Therapist.